National Payment Corporation of Vietnam (NAPAS) successfully organized “THE 2023 MISSION IMPLEMENTATION CONFERENCE” in Hanoi, on January 4, 2022. The conference organizers were honored to welcome Mr. Pham Tien Dung - Vice Governor of State Bank of Vietnam; representatives of Departments of the State Bank, Vietnam Banks Association; the Government Office, Ministry of Public Security; Board of Directors, Board of Supervisors and representatives of NAPAS.

At the beginning of the conference, Mr. Nguyen Quang Minh, Chief Executive Officer of NAPAS reported the performance of NAPAS in 2022. In view of the economic recovery after the covid-19 pandemic along with the economic fluctuations of the world as well as in the country, under the close direction of the State Bank and the Board of Directors, NAPAS has achieved remarkable results in 2022. This year is determined to be the pivotal year in the implementation of the Company Development Strategy for the 2021-2025 period, with a vision to 2030.

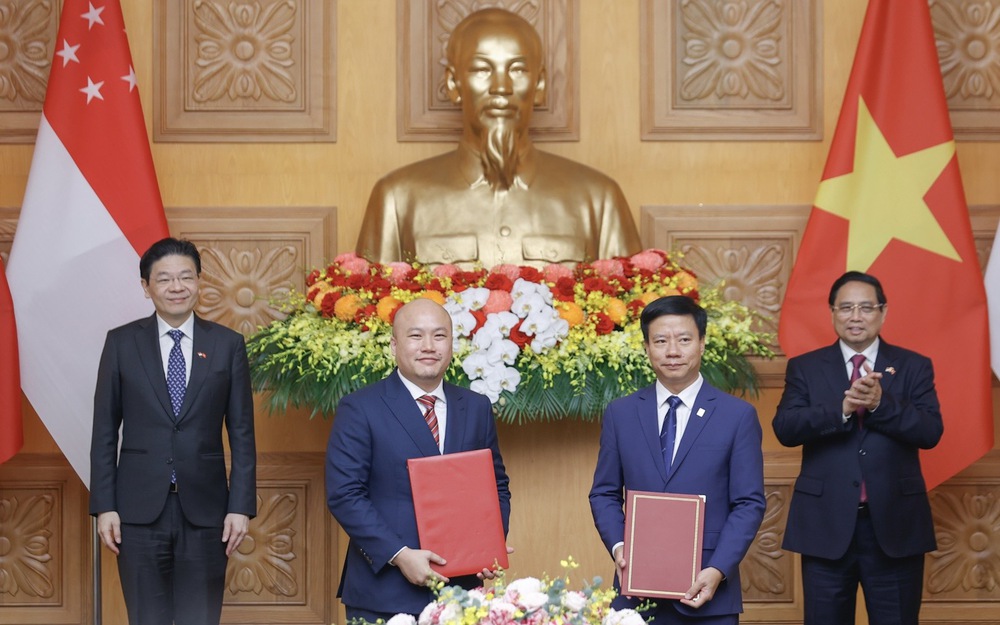

Chairman of the Board of Directors of NAPAS speaking at the conference

Accordingly, NAPAS has completed the key missions assigned by the State Bank of Vietnam; has closely followed the implementation plan of the project on development of non-cash payment in the 2021 - 2025 period of the banking sector; has promoted its role as a supplier of the national payment infrastructure, financial switching and electronic clearing services; has supported and cooperated with banks, financial companies, payment intermediary service providers and partners to develop digital payment ecosystem; has increased payment convenience and experience for all people.

In terms of ensuring safe, stable and smooth infrastructure operation in 2022, the service-level agreement (SLA) for ATM/POS switching services; online card payment and NAPAS 247 Quick Transfer service reached 99.996%. In which, NAPAS has been always ready for systems and resources; has developed plans to ensure the safety of important information systems. At the same time, it has expanded its processing capacity to meet the demand for a large number of transactions during peak times of the year.

The result of e-payment has continued to grow rapidly in 2022. The total number of transactions and total value through the NAPAS system rose by 96.5% and 87.3% from the figures last year, respectively. This year has continued to see the proportion of cash withdrawal transactions on total transactions processed through the NAPAS system decreasing from 12% in 2021, to 6.56% in 2022. The proportion of chip card transactions made through the NAPAS system increased from 26% in 2021 to more than 60% in 2022. The NAPAS 247 Quick Transfer service with VietQR code also had impressive growth after more than a year since launch; payment with VietQR code has become one of the popular payment methods and been well received by the market because of its convenience, simplicity and low cost.

Also in the past year, NAPAS has completed many key projects. These include completing the project of interconnecting NAPAS 247 Quick Transfer service with Mobile Money account at VNPT and Viettel; expanding the form of payment by VietQR code on the national public service portal with 17 banks; the projects strengthened international connections between card organizations and switching companies of Thailand, the Republic of Korea, Cambodia, and Russia. In addition, NAPAS has expanded the payment ecosystem and increased convenience for users by promoting cooperation with banks and financial companies participating in domestic credit card issuance as well as Vinbus payment service to customers of 18 banks.

Not only coordinating to deploy a variety of products and services with many utilities and reasonable costs to meet the payment needs of all people, from urban to rural areas, remote areas, NAPAS also implements many programs to support Member Organizations in 2022. Specifically: the member organization support program completed the conversion of chip cards according to the basic standards for domestic chip cards of the State Bank; marketing programs, incentives to encourage people's payment habits, etc. Particularly for the program of exemption and reduction of switching and clearing service fees, the total fee that NAPAS has reduced for member organizations in 2022 reached 1,743 billion VND.

Speaking at the conference, Vice Governor of State Bank of Vietnam Pham Tien Dung acknowledged the results and efforts of the NAPAS leaders and employees in 2022 in the context of difficulties and challenges of the domestic and foreign economy. In particular, Vice Governor of State Bank of Vietnam emphasized the reduction in the proportion of cash withdrawal transactions compared to the total transactions and the increase in the proportion of Vietnam Chip Card Standard (VCCS) processing – domestic chip card standards processed through the NAPAS system in 2022, these numbers showed a development in NAPAS’ operation. This also showed that banks have gradually shifted to VCCS chip cards. In addition, promoting payment implementation for seven public service groups on the National Public Service Portal and strengthening international payment connections with some countries are also a bright spot in NAPAS' activities in 2022, he added.

State Bank of Vietnam Vice Governor Pham Tien Dung delivering a speech at the conference of NAPAS.

In order to continue promoting the achievements and successfully complete the key missions assigned by the State Bank in 2023, the Vice Governor suggested that NAPAS should focus on implementing the missions related to the Company’s operations in the Directive of the Governor of the State Bank on organizing the implementation of key missions of the banking sector in 2023 on schedule, with quality and efficiency, specifically:

(i) Continuing to focus on investing in research and developing new products and services, investing in human resource development to meet the work.

(ii) Coordinating with competent units of the Ministry of Public Security and the Central Bank Department to ensure the security and safety of the system. At the same time, paying attention to the prevention of money laundering, managing the risk of fraudulent transactions, and minimizing the damage.

(iii) Improving the service quality through coordination of service providers to improve customer experience, provide convenient and safe products and services.

(iv) Continuing to promote the payment for public services in both the number of services and the number of users, with priority given to key areas such as healthcare and education.

(vi) Strengthening communication to help the public understand the convenience and safety of non-cash payment as well as the products, services and activities of the Company.

(vi) Continuing to take care of employees’ lives and the mechanism to attract experts in the field of payment.

At the end of the 2023 Mission Implementation Conference, Nguyen Quang Hung, Chairman of the Board of Directors of NAPAS, on behalf of the Board of Directors and all employees of the Company, committed to actively and closely coordinate with banks, payment intermediary service providers, domestic and international partners to build and develop a multi-service digital payment ecosystem, contributing to promoting the non-cash payment, comprehensive financial universalisation towards the goal of building a digital economy and digital nation set by the Party and Government.